This is how it works

Invoice as a private individual

Have you found your thing and want to be able to charge for your services? Then umbrella employment could be an option for you. Frilans Finans offers you as an individual an easy alternative to starting your own business. Umbrella employment gives you the opportunity to invoice without a company and you can easily charge for your services.

This is how it works Umbrella employment

For us, it is important that you quickly and easily can send an invoice so that you can focus on your business and what you want to do. Frilans Finans takes care of all the complicated things such as accounting, VAT and debt collection. With a few simple steps, we make it possible for you to get started and be able to get paid without having to start your own business.

You find assignments

Create Account

Create an account for free and without any commitment period. When you find an assignment you want to invoice for, register your assignment with us. It is only when you choose to create an invoice that a fee of 6% of the invoice amount is deducted.

Remember to let the client know that you are invoicing through Frilans Finans so that they understand where the invoice is coming from.

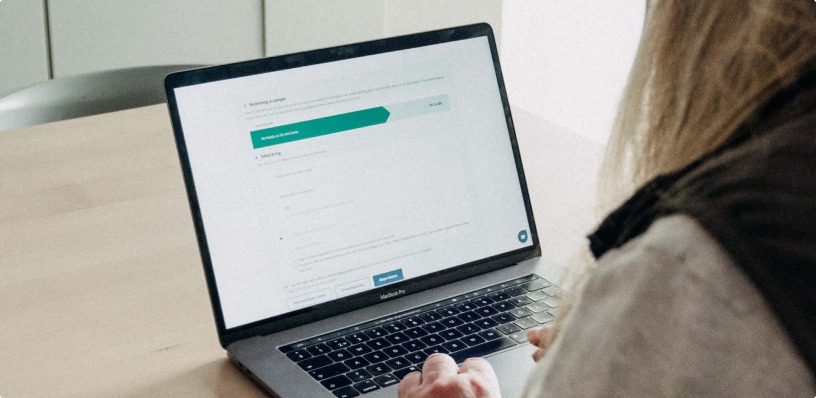

You create an invoice

Invoice as a private individual

How is it possible to invoice as a private person? During the assignment, you are employed by Frilans Finans, which makes it possible to charge and send invoices without paying income tax. You quickly and easily create an invoice in our invoicing tool and can then focus on your business.

Frilans Finans sends your invoices to the customer with clear instructions that you are the one who has carried out the assignment. You are always covered by our insurance, collective agreements and have support from client support.

We take care of everything else

Salary estimated and ready

Frilans Finans takes full employer responsibility and handles all administration. This means you don’t have to worry about paying taxes, fees, VAT or anything else that would be required if you were running your own business. You’ll get your salary assessed and ready usually within 5 business days of creating your invoice.

You declare your income as if you were employed.

You only pay 6% of the Invoice amount

Creating an account is free of charge. Only when you send an invoice will a fee of up to 6% of the invoice amount be deducted. Please use our calculator to calculate your invoice amount and your salary. You can find the calculator on our start page and when you log in to your account.

Distribution of the Invoice amount

Frilans Finans fee

Use us whenever and however much you want for a fee of up to 6% of the invoice amount. You don’t have to worry about other costs or commitment periods. By earning points in our loyalty programme with every invoice, it’s also possible to reduce your fee to a low 4%.

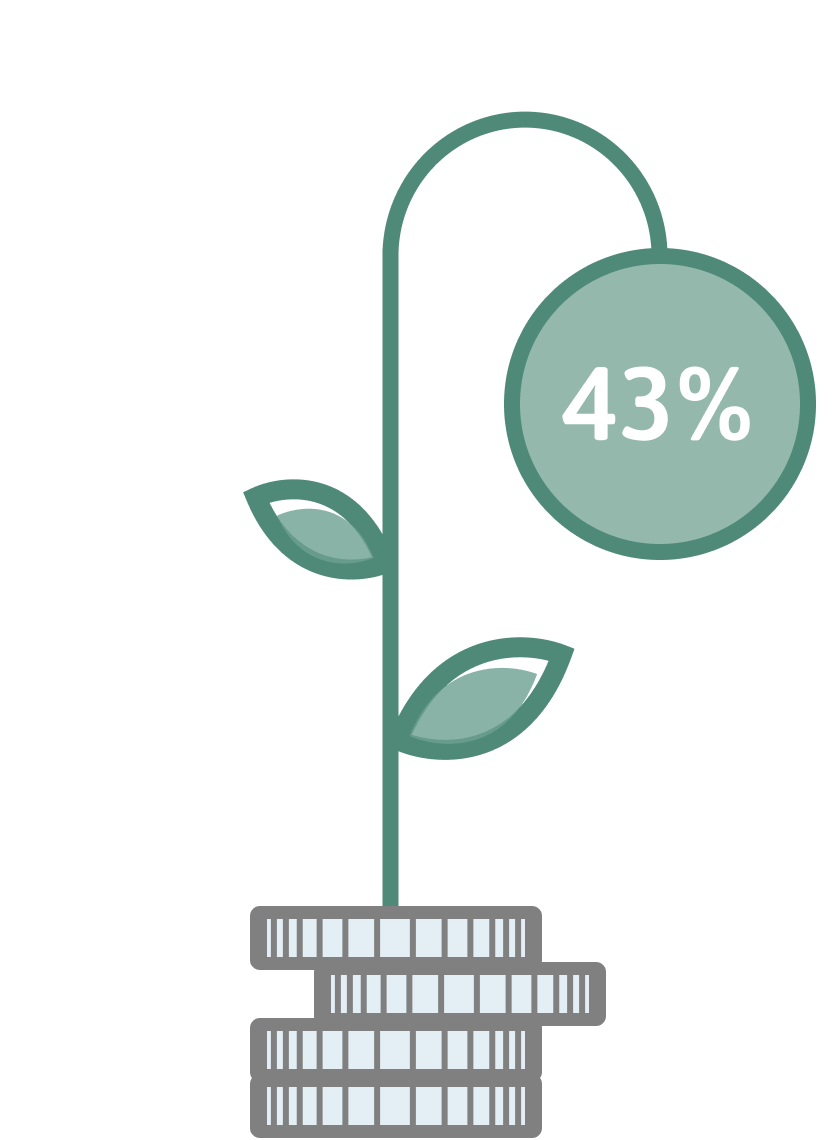

Income tax and employer's contribution

Everyone working in Sweden has to pay employer’s tax and income tax, a total of 43%. We handle all contact with the tax authorities and make all payments. If you would like us to pay more income tax, please contact us and we will help you.

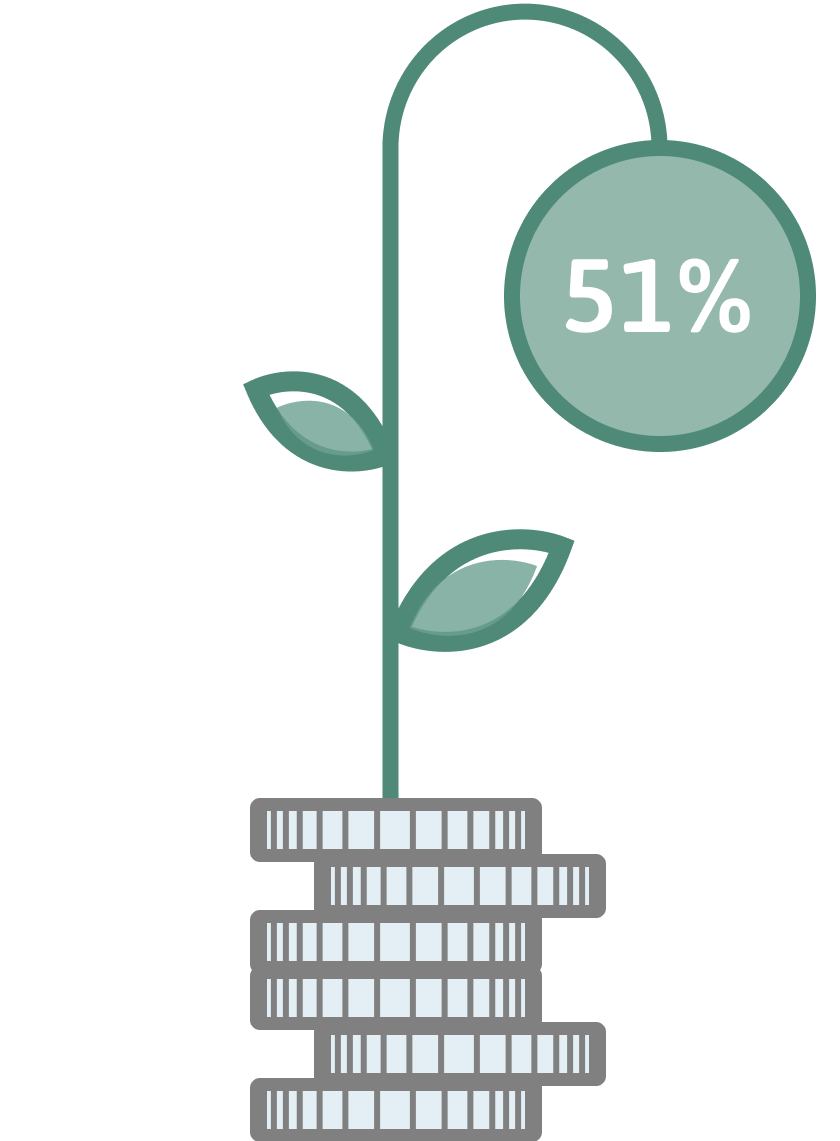

Your money

Your money consists of your net salary and occupational pension, which represents 51% of your billing amount. For those aged 25-65, we set aside 4.5% of gross salary in savings for occupational pension, you can always choose to set aside more.

The salary is usually paid into your account after 5 working days. You can also choose express payment, in which case your salary will be paid the same day.

This is how it works Invoicing

Customized invoicing tool

When you want to register an assignment or create an invoice, you enter the customer’s details, how much you have worked, a description of what you have done, how much you want to invoice and how the invoice should be sent to the customer.

It’s also possible to create more advanced invoices, including deductions, rot and rut, car reimbursements and per diems.

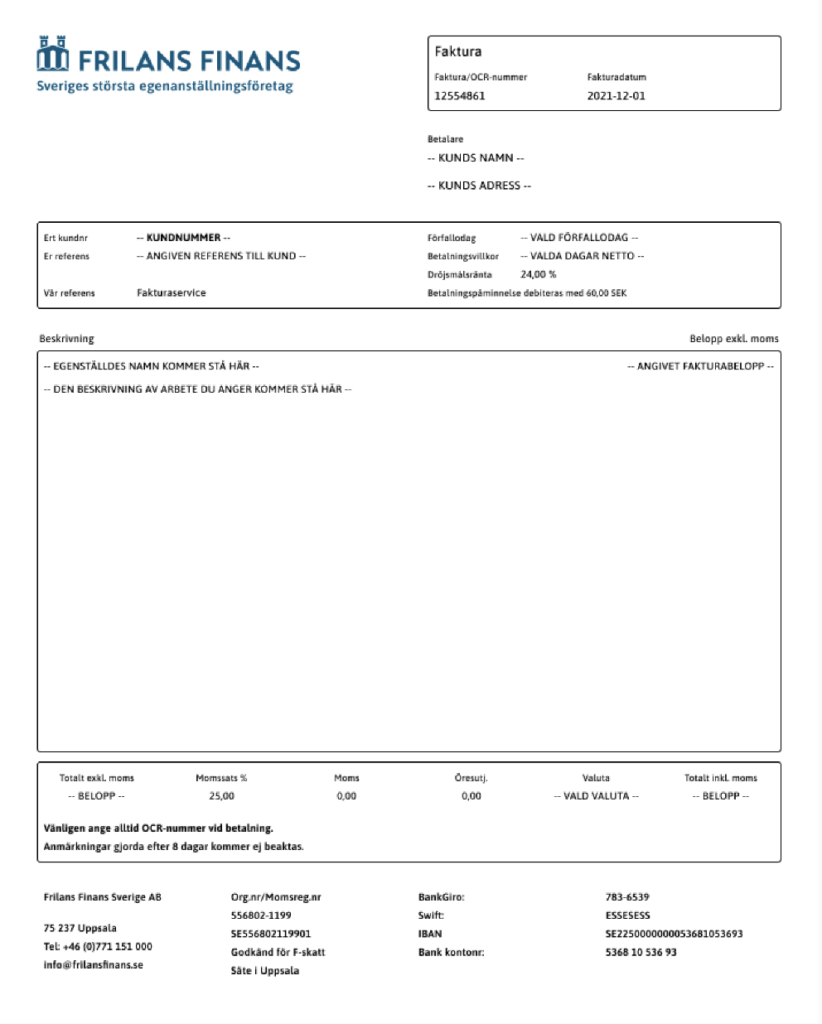

This is what your invoice looks like

The information and data you enter in the invoice tool automatically becomes an invoice to your customer. Your description along with your name will appear on the invoice to make it clear to your customer who carried out the job. You can also choose to add your own logo to appear on your invoice.

You can always preview what the invoice will look like when it is sent to the customer before you choose to submit it.

Follow your invoice

When you create an invoice in our tool Frilans Finans will review it. This means, among other things, that we carry out a credit assessment and make sure that the information provided is correct. You will shortly after receive an e-mail notification of the rating your invoice has received.

An approved invoice will be sent directly to the customer. You will then receive your salary even before the customer has paid the invoice. If the payment from your customer has not been received, Frilans Finans will send a reminder. You can always follow your invoices by logging in to your page.

If the invoice is approved with reservations or not approved, we will notify you and what this means. You are always welcome to contact us in advance to find out what assessment your invoice will receive.

This is how it works Support & security

Personal service

Assignments and benefits

Some examples of our partners: SATS, Myflow, Kvix, Brainville, Dorunner.

Insurance

Umbrella contracting This is always included

I am ready to be an umbrella contractor

- Free sign up and no lock-in period

- Focus on your thing and your customers

- Use us when you need it without obligation

Common questions and answers

How do I calculate my net pay, alternatively, what I should charge the customer?

You can use the Calculator on the homepage to calculate your net wages on the basis of the invoice amount, or vice versa.

Can I invoice through Frilans Finans even if I have a non-payment record in my credit history?

You are always welcome to invoice via Frilans Finans. The only difference compared to if you do not have non-payments in your credit history is that your pay is not transferred to you until the customer has completed its payment to Frilans Finans.

How do I claim a deduction for expenses?

You claim deductions for expenses directly from the invoiced amount and thus don’t need to pay these with taxed money. Example: you have made an agreement with the customer that you will receive remuneration of SEK 1,000 for services rendered. You have costs/expenses of SEK 200. You are therefore only taxed on SEK 800. The costs/expenses amounting to SEK 200 we pay directly to you, against the approved receipt(s) you have submitted. The costs/expenses are entered into the invoicing tool, Invoice, Part 2, which you can access via the “Create invoice” button that you see when you are logged in. For further information, refer to the Deductions Guide